are electric cars tax deductible uk

The exception is for cars registered after 1st April 2017 that cost over 40000. Second-hand electric cars can claim 18 of the cost of the car year on year on a residual value basis The company buys a used Nissan Leaf costing 10000.

Should I Buy Electric Cars Or Hybrid Now Automotive News

But in most cases the tax on domestic power usage is at a much lower rate just 5 VAT on.

. Because of the tax benefits of electric and hybrid cars this means Tom and the company can potentially save tax and National Insurance of 10103 overall. Opt for a low emission vehicle. From 1 April 2021 the enhanced ECAs.

According to new vehicle tax rates pure electric cars with no tail emissions will not pay road tax. There have also been reductions for electric hybrids depending on their electric-only range. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in.

If you buy the car personally you will have to use cash that has already been subject to corporation tax and income tax. As a result if your car is worth around 40000 you might receive a tax relief of 8400. Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget 2020.

For the example above purchasing the BMW i3 at 33340 would save corporation tax of 6335. These vehicles will be subject to a charge of 350 per year for the first five years a saving of 150 a year compared to diesel and petrol vehicles. Electric and ultra low emission vehicles ULEVs are great for more than just the environment as road tax and company car tax on electric cars is much lower.

Road tax for zero emissions car is free too. Second-hand electric do not qualify for a full tax deduction. You pay tax on the value to you of the.

Do electric cars get 100 capital allowances. Table of contents can i buy an electric car through my limited company uk 2021. Youll pay tax if you or your family use a company car privately including for commuting.

This could then be carried back to the previous year where relief at 19 could be claimed to obtain. TAX DEDUCTION UNDER SEC 80EEB TOWARDS PURCHASE OF ELECTRIC VEHICLE To promote the use of Electric vehicles in India the government come up with new section to give tax relief to EV buyers 1. For example a vehicle costing 36000 with CO2 levels of 32 gkm and an electric only range of between 30 and 39 miles will have a benefit rate of 12 in 2021-22 and be classified as having a taxable benefit of 4320.

Tax on company cars. If your business purchases a new and unused electric car you get full tax relief in the year of purchase. By choosing a Tesla car your business can claim a 100 year one deduction for the cost of the vehicle.

Cars with lower emissions benefit from reduced Benefit In Kind at 2 for 2022-23. Electric car capital allowances Capital allowances allow businesses to deduct the cost of an eligible expense from its annual tax bill. 100 First Year Allowance FYA First Year Allowance is claimable for up to 100 of the cost of qualifying low emission and electric cars.

Buy a 50000 car save 9500 in corporation tax. State and municipal tax breaks may also be available. However there have been significant reductions in this charge from April 2020 with electric-only cars falling to 0 in 2020-21 as well as reductions for electric hybrids depending on their electric-only range.

Electric cars are able to deduct entirely the cost of being sold from their pre-tax profits. Summary of Electric Car Tax Benefits In his March 2020 Budget Chancellor of the Exchequer Rishi Sunak confirmed that motorists buying electric cars would continue to benefit from the Plug-In Car Grant to 2022-2023 but it would reduce from 3500 to 3000 and cars costing 50000 or more would be excluded. For 2019-20 low emission cars up to 50gkm are taxed at 16 of list price or 20 for diesels.

Deducting the entire 82000 cost of the car from his corporation profits left a loss of 22000. If you purchased a Nissan Leaf and your tax bill was 5000 that. 1800 18 in year one saving 342 19 1476 18 in year two saving 369 25.

In addition 130 relief is available for installing. An electric car qualifies for a 100 first year allowance FYA if purchased new prior to April 2025 meaning the cost of the new car is fully deductible in the period of purchase for tax purposes. Electric car financial benefits.

Theres a government grant of 25k you can deduct from the price of an electric car costing less than 35k. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. However 100 ECAs can be claimed on the cost of a ULEV between 1 April 2020 and 31 March 2021 meaning the entire cost of the car can be deducted from company profits before corporation tax is payable.

The amount of the credit will vary depending on the capacity of the battery used to power the car. This compares very favourably to non-electric cars which receive only 6 570 or 18 1710 relief in year 1 depending on their CO 2 emissions. Theres also usually a vehicle tax of some sort although not always an incentivized reduction for EVs.

To assist in the growth of electric and PHEV options HMRC have changed their approach to company car tax as set out below. If you use your personal car for business journeys then you can charge the company 45p per mile for the first 10000 miles. The tax rules for ultra low emission company cars are set to change from 6 April 2020 making the purchase of an electric vehicle potentially more attractive for a business.

For many modern PHEVs there will be a 10-14 BiK banding so long as the. As with car tax and company car tax the rate at which a company can write down the value of company vehicles is based on its CO2 emissions. It can claim costs of.

The key points to note from the new taxation regime is that a purely electric vehicle will have 0 Bik for 2020-21 1 2021-2022 2 2022-23. With most cars this deduction will be applied gradually over time however with electric cars you can claim the full deduction in the year you buy it.

The Tax Benefits Of Electric Vehicles Saffery Champness

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Tax On Company Cars Does It Pay To Go Electric Rouse Partners Award Winning Chartered Accountants In Buckinghamshire

Russia Cancels Import Tax For Electric Cars In Hopes Of Enticing Drivers Bellona Org

Electric Cars In Limited Companies The Accountancy Partnership

Government Electric Car Grants Save On Your Ev Leasing Options

The Mileage Rates For Electric Or Hybrid Cars Friend And Grant

Electric Car Per Km Cost Off 77

Purchase Subsidies Zero Rate Tax And Toll Free Travel How To Incentivise Emobility Skoda Storyboard

Electric Car Per Km Cost Off 77

Road Tax Company Tax Benefits On Electric Cars Edf

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Road Tax Company Tax Benefits On Electric Cars Edf

What Are The Tax Benefits Of Having An Electric Vehicle

Electric Car Per Km Cost Off 77

Electric Cars Will Be Cheaper To Produce Than Fossil Fuel Vehicles By 2027 Automotive Industry The Guardian

A Complete Guide To Electric Cars Thinkev

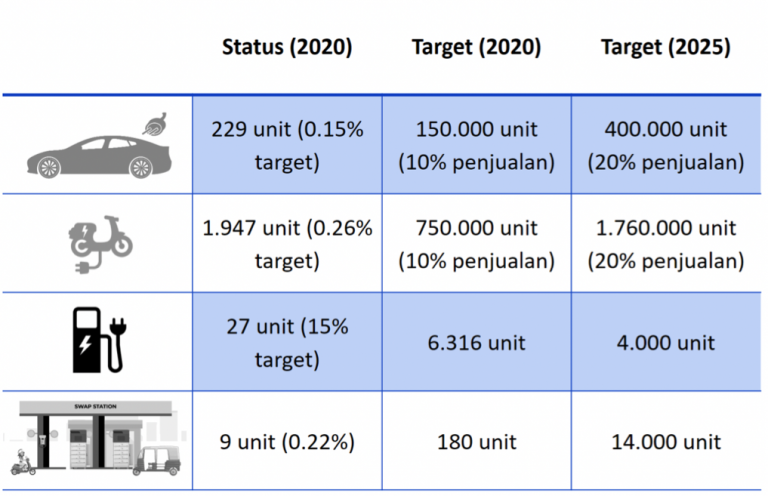

Corporate Strategy To Optimize The Development Of Battery Electric Vehicle In Indonesia Sbm Itb